20VC Exclusive: Roy Bahat on Bloomberg Beta's New Fund, The Truth About Valuation That Very Few VCs Will Tell You & Why Founders of Venture Backed Startups Make The Best Angels

20VC

Oct 17, 2019

Posted by

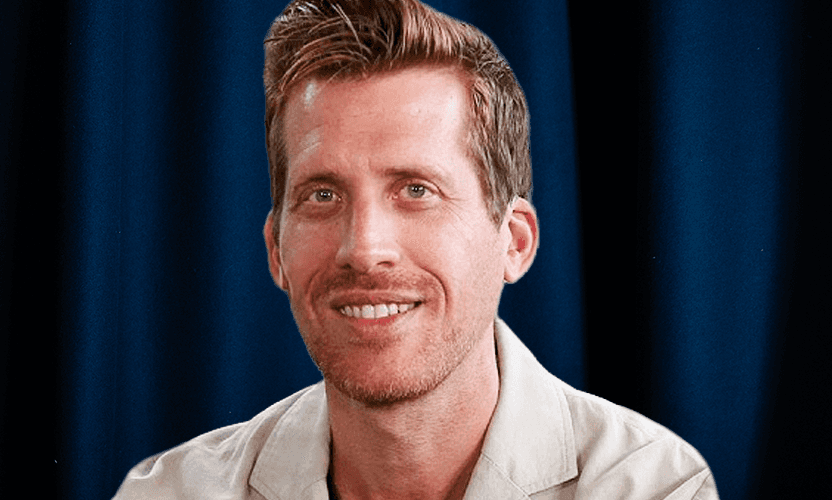

Roy Bahat is the Head of Bloomberg Beta, one of the leading early-stage funds in the valley and NYC with a portfolio that includes the likes of Flexport, Kobalt, Textio, Rigetti Computing and more incredible companies. Prior to Bloomberg Beta, Roy was the Co-Founder & Chairman @ Ouya, the company that created a new kind of games console and raised over $33m from the likes of Kleiner, Alibaba and even $8.6m on Kickstarter. Before the world of startups, Roy held numerous incredible and fascinating roles including Director of International Strategy at New York’s bid for the 2012 Olympic Games and also was a Senior Policy Director in the Office of the May of New York City.

In Today’s Episode You Will Learn:

1.) How Roy made his way from policy director for Mike Bloomberg to entering the world of venture and leading Bloomberg Beta?

2.) What is the big news when it comes to Bloomberg Beta? Roy has previously said, “your fund size is your strategy”, what did he mean by this? What does that mean for BB moving forward? How has Roy seen what founders want from their VC change over the last 6 years? How is being “founder-friendly” vs the founder being your “customer” different?

3.) Investment Decision-Making: Does Roy believe that speed is the biggest determinant in winning deals today? What else does Roy believe is crucial? What have been some of Roy’s biggest lessons in how to build trust early with founders? How does Roy and BB approach investment decision-making on initial investment? How does this change when it comes to reserve allocation decisions?

4.) Price sensitivity: Roy has said before that, “price is the dependent variable”, what does he mean by this? Why is it wrong to assume that the price a VC is willing to pay shows their level of belief in your company? How does fund size change this? How does Roy think about large multi-stage funds playing at seed? How has it impacted seed?

5.) Boards: Why does Roy call boards “b-o-r-e-d-s”? When does Roy think it is important to instil a board? Why is it dangerous to have a board too early in the life of a company? What have been some of Roy’s biggest lessons from sitting on a board with Alfred Lin @ Sequoia?

Items Mentioned In Today’s Show:

Roy’s Fave Book: Ain’t No Makin’ It: Aspirations and Attainment in a Low-Income Neighborhood

Roy’s Most Recent Investment: States Title

As always you can follow Harry, The Twenty Minute VC and Roy on Twitter here!

Share this post

Link copied