20VC: Three Core Lessons for Founders From the SVB Crisis From Financial Agility (Banking) to Constructing Scenario Plans and Mastering Crisis Communications | How The Western World Has Not Been Responsible with its Money & Why The Fed Is Backing Itself Into a Corner with Mike Maples

20VC

Mar 23, 2023

Posted by

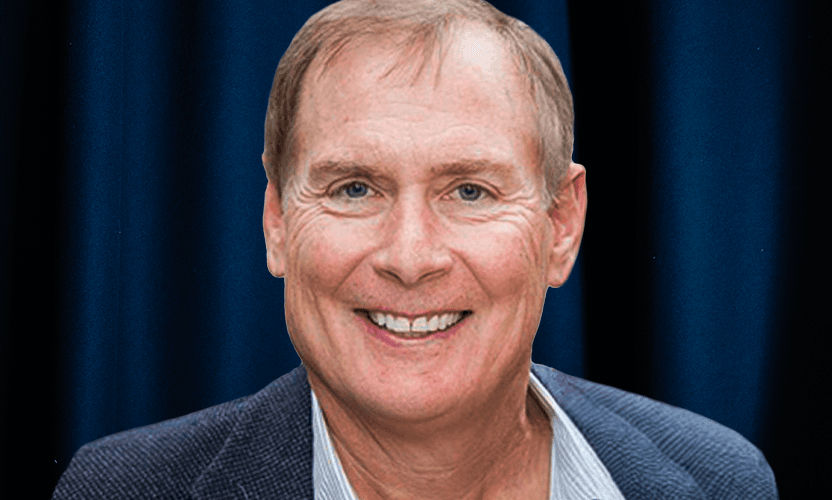

Mike Maples is one of the OGs of seed investing. As the Co-Founder of Floodgate, he has backed the likes of Twitch, Okta, Lyft, Twitter and more. Mike has been on the Forbes Midas List eight times in the last decade and was also named a “Rising Star” by FORTUNE and profiled by Harvard Business School for his lifetime contributions to entrepreneurship.

In Today’s Episode with Mike Maples We Discuss

1.) Lesson from SVB #1: The Importance of Scenario Planning:

What is the right way to do scenario planning in startups?

What is the difference between good vs bad scenario planning?

What do the best scenario plans include and involve?

What is the right way to communicate these scenario plans to your stakeholders?

2.) Lesson from SVB #2: The Importance of Financial Agility:

What does it mean for a startup to be “financially agile”?

From a banking relationships perspective, what can startups do to be financially agile?

How many accounts should a startup have? How much runway should be in each?

Should startups bank with startup banks as well as traditional banks?

Should startups have their money in sweep accounts and money market accounts?

3.) Lesson from SVB #3: How to Master Crisis Communications:

Why is it so important for founder to over-communicate in tough times?

How transparent should they be in these communications?

What does Mike mean when he says “be radically human”?

If Mike were to face a crisis, what would he do differently in the way he communicates to his LPs?

4.) Lessons from SVB: The Wider World:

Why does Mike believe the level of quantitative easing that occurred in COVID was scandalous?

Does Mike believe the USD will continue to be the reserve currency of the world?

Will we be in a better or worse macro situation by the end of the year?

Has Mike ever had a company that achieved true PMF and failed?

Share this post

Link copied