20VC: Lessons from 150 Angel Investments into the likes of Carta, Gusto, Airtable and Superhuman, Creating Algorithms and Models For Investing At Seed & Why Younger Investors Have An Advantage When It Comes To Finding Deals Early with Jude Gomila, Angel Investor & Founder @ Golden

20VC

Feb 10, 2020

Posted by

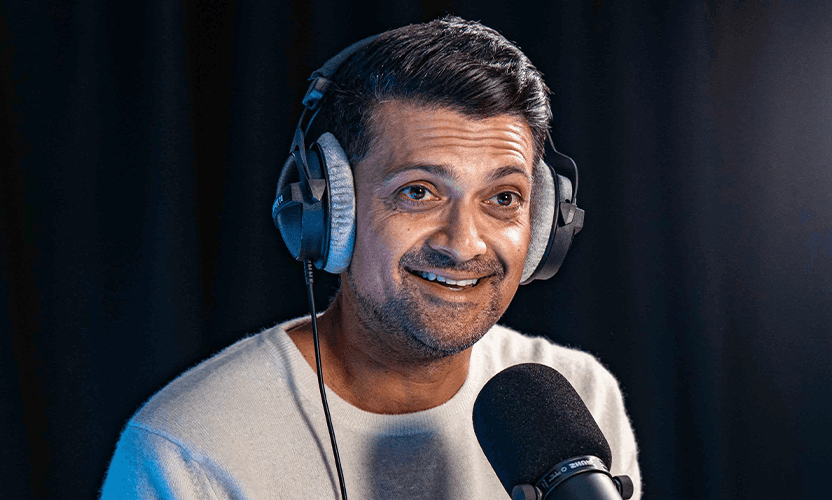

Jude Gomila is the Founder & CEO @ Golden, creating the world’s first self-constructing knowledge database built by artificial and human intelligence. To date, Jude has raised from some of the best in the business including Founders Fund, a16z, SV Angel and one of my dearest friends, Josh Buckley. Jude is also a prolific angel having invested in over 150 companies including Carta, Airtable, Superhuman, Gusto, Linear and many more incredible companies. Prior to Golden, Jude started Heyzap (now used by 100,000 mobile apps) alongside former guest Immad, now Founder of Mercury.

In Today’s Episode You Will Learn:

1.) How Jude made his way into the world of tech and Silicon Valley having been born and raised in Harrow, London? How did he then make his way into the world of investing?

2.) What models should investors and founders have common ground on? Where are founders and investors often misaligned? What does Jude mean when he says he uses “algorithms for investing”? How are these algorithms structured? What is within them? How can/should people build their own?

3.) Why does Jude very much disagree with spray and pray to be the dominant model to make money at seed? How does Jude think about portfolio construction having now made 180 investments? How has Jude’s approach and attitude to ownership changed over time?

4.) Does Jude agree with Semil Shah that founders are voting with their feet and taking multi-stage money at seed today? How does Jude evaluate the approach of multi-stage funds back into seed? How does Jude think about VC value add? Where does he believe they really can add value? Where do people think they do but they actually do not?

5.) How does Jude foresee the future of the early-stage market? Will we see a generation of old school venture firms die out? Why does Jude believe younger investors have a higher chance of finding and winning the next best deal? How does Jude believe the angel ecosystem will shake out? Will we fundamentally see the unbundling of capital?

Items Mentioned In Today’s Show:

Jude’s Fave Book: Godel, Escher, Bach: An Eternal Golden Braid

Jude’s Most Recent Investment: Linear

As always you can follow Harry, The Twenty Minute VC and Jude on Twitter here!

Likewise, you can follow Harry on Instagram here for mojito madness and all things 20VC.

Share this post